Table of contents

Market overview & growth drivers

Technology landscape-dynamic evolution

Commercial and Investment Landscapes

Barriers, Risks, and Challenges

Examples of Clinical Adoption and Real World Impact

Near Future Considerations (outlook 5-10 yrs)

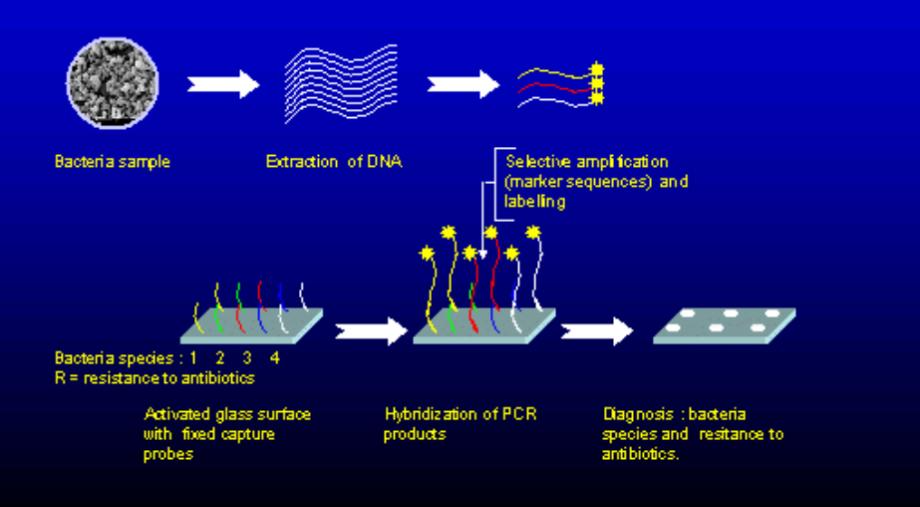

Concept (biochips)

Biochips are the smallest parts of the miniaturized devices to which biological and/or biochemical functionalities have been added at the chip level. A library of these includes microarrays, lab-on-a-chip/microfluidic systems, biosensor arrays, PCR-on-chip, and organ-on-chip models. Most likely; quite soon; next flexible-wearable bioelectronic patches along with other miniatures will be there to follow swiftly.

Biochips could become diagnostic tools in full-fledged combination with drug discovery, environmental tests, and POC monitor applications. In this way, there would be no need for the irritating workflows of large laboratories, which would be replaced with fast, low sample volume, high-throughput analyses done on-site/near the patient.

Market overview & growth drivers

Market size and growth: As a result of different methodological frameworks for estimating the global biochip market, its size is expected to be somewhere between a low-to-mid-ten billion range for the mid-2020s, with the compound annual growth rates varying in double digits for the following decade (2025-2035).

The most recent estimations: The most recent estimations put the value at somewhere in between USD 12 billion and USD 23 billion for the year 2024 and it is followed by estimations pointing to a market of over 40 billion USD by the early to mid-2030s depending on what is in the scope and how it is divided.

Rising Demand Driven by Aging Populations and Chronic Diseases:

Other examples of causes for this demand could be the world’s aging population and the chronic diseases which will require more diagnostics; cancer precision field; companion diagnostics;

Innovations in Microfluidics and Semiconductor Manufacturing: COVID caused the speed-up and decentralization of PoC testing; microfluidics and semiconductor manufacturing have got innovations;

Lab-on-Chip and Microfluidic Systems: The Fastest-Growing Segment:

Lab-on-chip/microfluidic systems will be the segments that will have the fastest growth due to home or near-patient testing and rapid molecular assays as well as organ-on-chip and PCR-on-chip technologies for the research and development and companion diagnostics sectors.

Technology landscape-dynamic evolution

- Microarrays & high-density multiplex chips

Ability to measure thousands of markers for nucleic acids or proteins simultaneously. Being used in genomics and transcriptomics for large scale biomarker discoveries. - Microfluidic Lab-on-Chip

Sample preparation, reaction, and detection integration on small channels which lowers reagent consumption and turnaround time; point-of-care molecular testing and decentralized laboratories are very important for that. - PCR-on-Chip and isothermal amplification platform

High-speed molecular diagnosis- miniaturized thermocycling or isothermic chemistry for the rapid identification of pathogen and genetic variant. - Biosensor Arrays:

On this surface, sensors are actively employed to detect nucleic acids, proteins, metabolites, and such. These being extremely good for medical diagnostics, environmental monitoring, and a variety of other applications, are among the other emerging portable systems. - Organ-on-Chip and organoids conjunction

Microphysiological systems simulating drug testing and toxicity screening organs; those organoid-chips are facilitating personalized preclinical testing. The integration of organoid-chip has been demonstrated through recent scholarly advancements – e.g., vascularized heart organoids – and is moving towards patient-specific drug evaluation. - These facilitate single-molecule or cell-level sensitivity for biomolecule or ion detection by the use of nanostructured surfaces and artificially made probes.

- Integration of Data/Artificial Intelligence & Multi-Omics

The chips produce extremely large data streams that are currently being handled by machine learning for pattern learning, multi-omic integration: genome, transcriptome, proteome, and metabolome, and in the end, make their raw outputs clinically actionable

Integrated Multiomics Systems

Biochip data will combine multiomic and lifestyle insights to provide algorithm-driven personalized health and treatment guidance.

Formation of industry trends

- Decentralized and precise POC

Molecular assays have nowadays been transformed to readers by miniaturization and a very robust solid-state technology, biosensors being the most advanced technology, testing will be immediately done outside a clinical facility and thus in pharmacies and private homes; diagnostic time will be short, and the speed of decision-making in relation to a therapeutic intervention will be greatly facilitated. - Theranostics

Miniaturised chip systems are doing extremely well progress-wise for tumors and critical care applications, providing the simultaneous detection of a biomarker with the subsequent recommendation of the immediate therapeutic action, the most common therapeutic measure being the change of drug infusion. - Integration with Wearables and Continual Monitoring

At present, flexible electronics and microfluidics are respectively being integrated in wearables, like patches or smart textiles, thus gradually being able to capture the biological signals over time for personalized healthcare. - AI and Edge Analytics

On-chip pre-processing and embedded AI would a void the need for excessive data transfer and, at the same time, allow almost immediate interpretation at the bedside or on a wearable device. - Organ-on-chip and patient-specific models in drug selection

Drug selection using chip-based patient-specific models has become the main focus of increased investment by pharmaceutical companies with the goal of human and outcome prediction in selecting the most efficient patient-tailored therapies to lessen attrition in the clinical pipeline. - Platformizing + Modular Assay Ecosystems

More and more vendors are introducing modular cartridges with interoperable readers that support a larger pool of assays from which clients can choose to reduce costs and increase applicability of use across different conditions. - Evolving Regulatory Clarity and Reimbursement Pathways

These reasons have together enabled the framing of the very first regulations with respect to companion diagnostics and POC molecular devices. After tests have been clinically validated leading to meaningful differences in outcomes while costs downstream being lowered, payers started to reimburse them. - Mass Production Using Semiconductor / MEMS Technologies Suitable for Manufacturing

Changes in semiconductor fab and MEMS technologies open up the possibilities for mass production of low-cost chips for nearly any application.

Commercial and Investment Landscapes:

The most attractive commercial applications for investments are companion diagnostics for oncology purposes, point-of-care diagnostics for infectious diseases, pharmacogenomics panels, organ-on-chip drug application testing, and wearable biosensing devices.

These will be considered as future areas of venture and strategic pharmaceutical partnership startup .funding can develope across assay chemistry, hardware, and AI usage. The firm consolidation of the industry will result in larger diagnostics. Semiconductor companies acquiring the required niche chip capabilities from smaller manufacturers.

Regional hubs: North America and Europe are leading in research and development, regulatory acceptance, and commercialization; whereas APAC has an expanding market which is becoming increasingly cost-sensitive for mass testing with a significant rise in health infrastructure investment. Reports indicate different numbers for each region but are consistent in showing a strong share for North America and rapid growth rates in APAC.

Barriers, Risks, and Challenges:

In addition to proving analytical performance, clinical validation and regulatory approval will be a lot more challenging and expensive, and thus, more substantial evidence would need to be provided (in terms of gathering) by regulators for such utility and benefit of companion diagnostics.

Data privacy and security are related to the very sensitive genomic and health information from biochips to continuous monitoring. Thus, secure storage, consent models, and data-sharing protocols become very important; an incident can very much put the process in question and be detrimental.

Interoperability & standards need to define assay format, data schema, and reporting standardization in order to allow the integration of chip outputs to EHRs and clinical pathways.

Cost and coverage- the price of the device upfront or the per-test pricing should be in line with acceptable reimbursement policies related to cost-effectiveness reasons.

Equity/access problem- precision tools, by their very nature, have the potential to increase health inequalities; therefore, their deployment strategy should incorporate the maximization of access.

Examples of Clinical Adoption and Real World Impact

Pharmacogenomic panels have been linked with the reduction in adverse drug events and hospitalizations caused by optimized dosing of antidepressants, anticoagulants, and drugs used in oncology. (Refer to pharmacogenomics literature for results in various drug classes.)

POC molecular biochips have been instrumental in the rapid triage of infectious diseases (SARS-CoV-2, flu, and sepsis markers), thus, patient management and throughput have been significantly influenced.

Organoids-on-chip drug screening has been found to be good indicators of treatment response in certain cancers and may shorten the time to effective therapy for those patients who were previously considered as failed cases.

1 .Supporting high-impact utilization: Commence the work from any genomic/biomarker data which currently leads to treatment change for e.g. oncology, transplant, rare genetic diseases; pharmacogenomics.

- Validate platforms: Limit devices with regulatory clearance and peer-reviewed clinical evidence to your priority.

- Unify data pipelines: EHR compatible clinical decision support that transforms chip output into executable orders.

- Governance & consent: Policies regarding the use and sharing of genomic data along with patient consent are still not very clear.

- Pilot & measure: Pilot programs with control over time-to-therapy, outcome, cost per case, and patient experience metrics.

- Scale with partners: By creating reimbursement models and supply chain partnerships with laboratories, device vendors, and payers.

Near Future Considerations (outlook 5-10 yrs)

Point-of-care molecular testing will become deeply involved in common diseases and frailty indicators that are part of standard pathways of care in the coming years.

Active biochips are expected to link continuous streams of markers with lifestyle factors, thus genuinely personalizing care plans in a very flexible manner.

In their oncology centers, institutions routinely work organ-on-chip screens to decide on therapies for second-line or refractory disease.

Multi-omic decision systems operating on chip outputs would be the source of an indication for therapy selection, dosing, and monitoring schedule.

Anticipate is that new laws with privacy and ethical frameworks, along with lower per-test costs and modular platforms, will provide access to biochip technologies.

Concluding Thoughts

Biochips represent a key enabling technology for personalized medicine. They simplify highly complex laboratory procedures into chips and gadgets that can efficiently and accurately assess genetic, molecular, and physiological states-with the further assistance of informatics and AI in making individualized treatment decisions. This is a rising market now, mainly driven by clinical demand (precision oncology, pharmacogenomics), enabling solutions (microfluidics, organ-on-chip), and a growing need for tests that are rapid and decentralized. The major issues most of which remain are clinical validation, data governance, reimbursement, and access equality.

I am very enthusiastic about the market growth which is currently happening in a very fast manner and the existence of a lot of clinical needs is a positive factor around that, be it precision oncology or pharmacogenomics.

There are novel technologies such as microfluidics and organ-on-chip, and, certainly, the last driver is that the demand for testing to be done quickly and less centralized.

Thelazol market growth, mostly, it seems, of the QUALLOC and Moru Foundation, was the big driving forces behind the aggressive growth currently in the market are clinical needs (precision oncology, pharmacogenomics), enabling technologies (microfluidics, organ-on-chip), and rising demand for faster and decentralized testing. There are still important hurdles like clinical validation, data governance, reimbursement, and fair access that need to be addressed.

Leave a Reply